How to Identify Target Customers for a Product isn’t about guessing or picking a broad audience and hoping it works. It’s about slowing down and figuring out who actually needs the product, why they’d care, and what pushes them to buy. This guide breaks that process into clear, workable steps, starting with understanding the product itself, then digging into real customer data, market research, and competitor gaps.

It explains the often-mixed-up difference between target customers, target markets, and target audiences, and why that distinction matters more than most teams think. Along the way, it shows how to segment customers, build usable buyer personas, rule out poor-fit users, and validate assumptions with real signals; so marketing and product decisions are based on reality, not instinct.

Table of Contents

Introduction

What Does “Target Customers for a Product” Mean?

Target customers are not a theoretical group pulled from a slide deck. They’re the people who actually feel the problem the product is trying to solve. The ones who recognize the friction in their day, who’ve tried workarounds, who are already a little frustrated. When the product shows up, it makes sense to them almost immediately.

That’s the difference.

A lot of products technically work for many people. Very few are truly meant for everyone. Target customers sit at that intersection where need, timing, and willingness to act all overlap. Miss that, and even a good product struggles to gain traction. Not because it’s flawed, but because it’s speaking to the wrong crowd.

Why Identifying Target Customers Is Critical for Growth, Conversion, and ROI

Most growth problems don’t start in marketing. They start earlier, with an unclear customer definition.

When target customers are vague, everything downstream becomes harder. Messaging sounds generic. Ads attract curiosity but not commitment. Sales cycles drag on because the value has to be explained instead of recognized.

On the other hand, when target customers are clearly understood, things tighten up:

- The product feels easier to explain

- Marketing resonates faster

- Conversions improve without constant optimization

- Spend goes where intent already exists

There’s also a quieter benefit. Teams make better decisions. Fewer debates about “who this is for.” Fewer compromises that water the product down. Clarity removes friction internally as much as it does externally.

Overview of the Process: From Product Analysis to Segmentation to Persona Creation

Identifying target customers isn’t about pulling a persona out of thin air. It’s a progression.

It starts with the product itself. What it actually does. What it doesn’t. Then it moves outward into the market, breaking large groups into smaller, more meaningful segments. Only after that does it make sense to shape those insights into clear customer profiles that teams can actually use.

Skip a step, and things feel off. Do it in order, and the picture sharpens naturally.

Target Customers vs Target Market vs Target Audience

This is where confusion usually creeps in. The terms sound similar, but they serve very different purposes.

Target Customers: The People the Product Is Built For

Target customers are the highest-intent buyers. They don’t need convincing that the problem exists. They’re already aware of it. What they’re evaluating is whether this product solves it better, faster, or with less friction than what they’re using now.

These customers shape the product more than anyone else. Their needs influence features, pricing, onboarding, and even what not to build. When teams say they’re “listening to the customer,” this is the group that should be front and center.

Target Market: The Bigger Playing Field

The target market is broader. It includes everyone who could reasonably benefit from the product, even if they’re not ready to buy today.

This group matters for understanding:

- Market size

- Long-term growth potential

- Expansion opportunities

But treating the entire target market as immediate customers is where strategy starts to unravel. Not everyone who can buy will. And that’s fine.

Target Audience: Who the Message Is Aimed At

The target audience is more tactical. It changes based on the campaign, channel, or goal.

A brand might speak to one audience in educational content, another in paid ads, and a narrower one in sales outreach. All of those audiences can exist within the same market, without all of them being core customers.

How These Concepts Work Together

When the lines are clear, alignment follows.

- The product is designed around target customers

- The business strategy considers the full target market

- The marketing adapts messages for different target audiences

Problems usually show up when these blur together. Products get overextended. Messaging tries to appeal to everyone. And no one feels like it was made specifically for them.

Understand Your Product Inside Out

Before looking outward at customers, the product needs an honest look inward. Not the polished version. The real one.

Product Features, Benefits, and Value Proposition

Features are easy to list. Benefits take more thought.

A feature explains what the product does. A benefit explains why that matters in someone’s day-to-day life. If that connection isn’t clear internally, customers will feel it immediately.

It helps to pressure-test the value proposition:

What problem does this solve?

How painful is that problem, really?

What changes for someone once it’s solved?

Strong products don’t just offer functionality. They remove friction, save time, reduce risk, or make decisions easier. That’s the value customers respond to, even if they never say it out loud.

Product Use Cases and Customer Needs

Products don’t exist in a vacuum. They show up at specific moments.

A deadline is approaching. A cost-cutting decision. A recurring annoyance that’s finally become too loud to ignore.

Understanding those moments matters more than guessing demographics. Who needs this product often becomes obvious once the situation is clear. The need comes first. The customer profile follows.

When teams get specific about use cases, not just who the product is for, but when and why it’s used, identifying target customers stops feeling abstract. It starts to feel grounded. Practical. Real.

And that’s usually when things start to click.

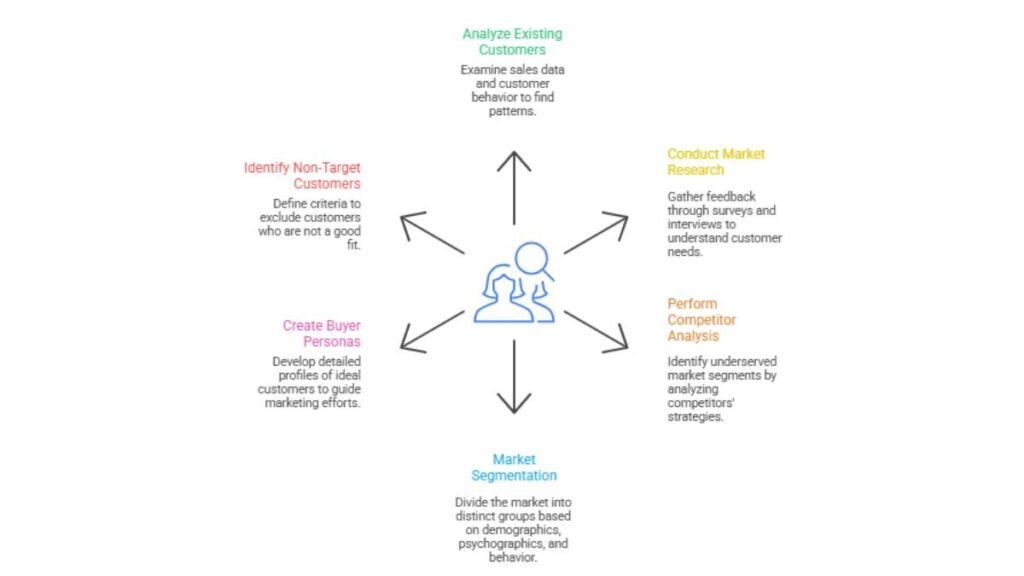

How to Identify Target Customers for a Product (Step-By-Step)

This is where assumptions usually get exposed. It’s also where clarity starts to form, if the work is done honestly. Identifying target customers isn’t about finding a perfect profile. It’s about narrowing focus until patterns start repeating and decisions stop feeling fuzzy.

1. Analyze Your Existing Customers and Sales Data

If the product already has customers, even a small number, they’re the most reliable starting point. Not because they’re perfect, but because they’ve already voted with their behavior.

Look for patterns rather than averages.

Who buys repeatedly?

Who sticks around longer?

Who asks fewer basic questions and gets value faster?

Pay attention to:

- Common roles or responsibilities

- Similar reasons for buying

- Purchase timing and triggers

- Drop-off points where interest fades

The goal isn’t to describe everyone. It’s to spot the customers who feel like a natural fit. Those are often the ones shaping the real target customer profile, whether that was intentional or not.

2. Conduct Market Research and Customer Surveys

Data shows what happened. Research explains why.

When gathering feedback, avoid questions that lead people toward polite answers. Focus instead on what pushed them to act, hesitate, or walk away.

Useful areas to explore:

- What problem were you trying to solve

- What alternatives did they considered

- What nearly stopped them from choosing this product

- What mattered most in the decision

Patterns here tend to repeat quickly. When multiple people describe the same frustration in different words, that’s usually a strong signal. Those signals help separate casual interest from genuine intent.

3. Perform Competitor Analysis to Spot Gaps

Competitors are already educating the market. That’s useful.

Instead of copying what they do, look for what’s missing:

- Who are they clearly targeting?

- Who seems underserved or ignored?

- Where do their messages feel generic or overextended?

Sometimes the strongest opportunity isn’t competing head-on, but narrowing focus where others stayed broad. Gaps often show up in tone, priorities, or the way problems are framed, not just in features.

4. Market Segmentation for Identifying Target Consumers

Segmentation helps break large, vague markets into something usable. The mistake is stopping at surface-level categories.

Demographic segmentation helps set context. It explains who someone is on paper.

Psychographic segmentation explains how they think, what they value, and what they avoid.

Behavioral segmentation shows how they actually act.

Geographic segmentation matters when location changes, needs or access.

No single segment tells the full story. The real insight comes from overlap.

For example:

People in similar roles, facing the same pressure, behaving in similar ways, even if their demographics don’t perfectly match. That overlap is often where true target customers sit.

5. Create Detailed Buyer Personas for Target Customers

Personas shouldn’t feel like character profiles. They should feel like decision filters.

A useful persona answers practical questions:

- What problem shows up first?

- What makes this problem urgent?

- What objections slow the decision down?

- What outcome actually matters to them?

Details like age or job title matter only when they influence behavior. Pain points, motivations, and constraints matter more. When teams can picture how this person thinks through a decision, messaging and product choices tend to align naturally.

6. Identify Who Is Not Your Target Customer

This step is uncomfortable, but necessary.

Not everyone should be convinced. Some people cost more to acquire than they’re worth. Others expect the product to solve problems it never will.

Clear exclusion criteria save time, budget, and internal energy.

Signs someone is not a target customer often include:

- Constant price resistance without clear value concerns

- Requests that pull the product away from its core use

- High effort onboarding with low long-term engagement

Saying no to the wrong audience sharpens focus on the right one. That focus compounds over time, quietly but consistently.

This step-by-step process doesn’t end with a single document or profile. It evolves as the product and market do. But once the foundation is set, decisions stop feeling reactive. They start feeling intentional.

Validate Your Target Customer Assumptions

At some point, every team reaches a version of “this makes sense.” That’s not validation. That’s a hypothesis.

Target customer assumptions need pressure. They need to be tested in the real world, where attention is limited, and decisions aren’t always logical.

One of the simplest ways to do this is through messaging experiments. When a message truly resonates, people don’t just notice it. They respond. They click. They ask better questions. They move forward faster.

Watch for signals like:

- Which messages spark immediate interest versus polite curiosity

- Where people hesitate, ask for clarification, or drop off

- Which promises feel obvious and which feel like a stretch

Conversion patterns tell a story if you pay attention long enough. When the right audience sees themselves in the message, the conversation feels easier. Less explanation. Fewer objections. Shorter paths to action.

Validation isn’t about being right once. It’s about staying open to what the behavior is showing, even when it challenges earlier assumptions.

Apply Now: Advanced Digital Marketing Course

Use Target Customer Insights to Improve Marketing

Once target customers are clearly defined and validated, marketing stops being a guessing game. It becomes a series of informed choices.

1. Tailor Your Product Messaging for Target Customers

Good messaging doesn’t try to impress. It tries to be understood.

When target customers are clear, messaging shifts naturally:

- From features to outcomes

- From broad claims to specific relief points

- From “anyone can use this” to “this fits your situation.”

Language matters here. The words customers already use to describe their problems often outperform polished marketing phrases. Familiar beats clever. Clear beats complex.

When messaging mirrors how customers think about their problem, trust builds quietly. And trust converts.

2. Choose Channels Based on Target Audience Behavior

Not every channel deserves equal attention.

Some audiences research deeply. Others skim and decide quickly. Some rely on recommendations. Others want proof and reassurance.

Choosing channels based on behavior rather than trends helps avoid wasted effort. It also aligns expectations. If the audience tends to compare options slowly, the content needs depth. If decisions happen fast, clarity and timing matter more than volume.

When channels match behavior, marketing feels less forced and more natural.

3. Optimize Your Marketing Budget by Targeting High-Value Customers

Not all customers contribute equally. Some bring long-term value. Others convert once and disappear.

Target customer insights make it easier to prioritize:

- Audiences that convert consistently

- Segments that stay longer or buy again

- Groups that require less persuasion

Budget optimization isn’t about spending less. It’s about spending where momentum already exists. When focus tightens, efficiency follows. Quietly, but noticeably.

Tools and Techniques for Identifying Target Customers

Tools don’t create insight. They organize it.

Used well, they surface patterns that might otherwise stay hidden. Used poorly, they add noise.

Analytics platforms help reveal behavior over time. Where people come from. What they engage with. Where interest fades. Customer relationship systems show how different groups move through the buying process, not just whether they convert.

Surveys and feedback tools add context. They capture motivations, doubts, and expectations that numbers alone can’t explain. Short, focused inputs here often deliver more value than long questionnaires.

Market and competitor research tools help zoom out. They show where attention is flowing, what language dominates the space, and where positioning starts to blur.

The key is restraint. Use tools to answer specific questions, not to collect data for its own sake. Insight comes from synthesis, not volume.

When tools support clear thinking instead of replacing it, identifying target customers becomes easier, sharper, and far more useful.

Case Study Examples

Sometimes theory clicks only when it’s grounded in reality. Patterns are easier to spot when they show up in context.

Example 1: How a Running Shoe Brand Identified Ideal Customers

Instead of chasing “everyone who runs,” the brand narrowed its focus to people training for their first long-distance race. Not elite athletes. Not casual joggers. People in between. The ones juggling ambition with uncertainty.

This shift changed everything. Messaging moved away from performance specs and toward confidence, injury prevention, and consistency. The product didn’t change much. The framing did. And suddenly, the audience felt seen.

The takeaway here isn’t about shoes. It’s about precision. The more specific the customer situation, the easier it is to connect.

Example 2: A Niche Food Product’s Segmentation Success

In another case, a food brand realized its strongest customers weren’t defined by age or income, but by habits. Busy weekdays. Health-conscious decisions are made under time pressure. A desire to feel “good enough” without overthinking meals.

By focusing on behavior rather than demographics, the brand stopped competing with mass-market options and started owning a smaller, more loyal segment. Growth followed, quietly and steadily.

These examples work because they reflect a common truth: when target customers are clearly understood, positioning becomes simpler, not more complicated.

Common Mistakes When Identifying Target Customers

Most mistakes here come from rushing the process or overcomplicating it.

One of the most common issues is overly broad targeting. When a product is described as being for “anyone who needs X,” it usually ends up resonating with no one in particular.

Another frequent misstep is ignoring psychographics and behavior. Demographics alone rarely explain why people buy. Two customers can look identical on paper and make decisions for completely different reasons.

There’s also the habit of treating early assumptions as facts. Initial ideas are useful starting points, not final answers. When they’re not tested against real behavior, they tend to drift further from reality over time.

And finally, many teams avoid defining who the product is not for. This avoidance leads to bloated messaging, unfocused features, and stretched budgets.

Most of these mistakes aren’t dramatic. They’re subtle. That’s why they persist.

Conclusion

Identifying target customers isn’t a one-time task or a box to check. It’s an ongoing practice that sharpens how products are built, marketed, and improved.

The process works best when it’s grounded:

- Start with a clear understanding of the product

- Look for real patterns in customer behavior

- Segment with intention, not just labels

- Validate assumptions before scaling them

- Be honest about who doesn’t belong in the core audience

When target customers are well defined, decisions feel lighter. Messaging becomes clearer. Resources are used more intentionally. Growth feels less forced.

The goal isn’t perfection. It’s alignment. And when that alignment is in place, everything else tends to move faster, with fewer surprises along the way.

FAQs: How to Identify Target Customers for a Product

1. What are the target customers for a product?

Target customers are the people a product is really built for. Not everyone who might click an ad or skim a landing page, but the ones who feel the problem strongly and are willing to act on it. They see the product and think, this solves something I’m dealing with right now. When teams get this right, decisions get simpler. Messaging sharpens. Even product tweaks start to make more sense.

2. How do you identify target customers for a new product?

With new products, there’s rarely perfect data at the start. That’s normal. The work begins by looking at the problem itself: who runs into it most often, how they describe it, and what they currently do instead. Early assumptions are fine as long as they’re treated like drafts, not final answers. Pay attention to reactions. Confusion, excitement, hesitation. All of it tells you something useful if you’re listening closely.

What is the difference between target customers and target audience?

This is where many strategies quietly fall apart. Target customers are the buyers, the ones who decide, pay, or strongly influence the decision. The target audience is often wider and more tactical. Ads, content, and campaigns may speak to users, researchers, or even managers, while the buyer sits slightly offstage. Mixing these up usually leads to marketing that sounds busy but doesn’t move revenue.

Why is identifying target customers important for product success?

Because without clarity here, everything else becomes guesswork. Features get added “just in case.” Messaging tries to please too many people. Budgets are spread thin. When the right customers are clearly defined, focus improves across the board. Teams stop chasing attention and start building relevance. That shift alone often changes results more than any new tactic.

What data is needed to identify target customers accurately?

It’s tempting to hunt for more data, but what matters most is the right kind. Buying behavior, repeat usage, objections, drop-off points; these usually say more than age or job title. Qualitative insight matters too. The words customers use, the frustrations they repeat, and the benefits they mention without being prompted. That’s where real clarity tends to show up.

How does market segmentation help identify target customers?

Segmentation forces choices. Instead of treating the market as one big group, it breaks it into smaller, more honest clusters. Some segments value speed. Others want control. Some care about price, others barely mention it. Once these differences are visible, it becomes easier to decide who the product is for, and just as important, who it’s not.

Can small businesses identify target customers without expensive tools?

Yes, and many already do without realizing it. Sales conversations, support emails, reviews, and even casual feedback contain patterns. The key is slowing down enough to notice them and write them down. Over time, those notes add up to a clearer picture than most dashboards ever will.

How often should you revisit or update your target customer profile?

Whenever reality starts pushing back. If conversion drops, if sales cycles stretch, if messaging feels harder to explain than it used to, that’s usually a signal. Markets change. Products evolve. Customer expectations shift quietly, then all at once. Revisiting profiles keeps strategy grounded instead of nostalgic.

What are common mistakes when identifying target customers for a product?

Going too broad is the classic one. Another is relying only on surface traits and skipping motivations and behavior. There’s also the habit of locking assumptions in too early, then defending them even when results say otherwise. These mistakes don’t look dramatic at first, but they compound over time.

How do you know if you’ve identified the right target customers?

Things start to feel… smoother. Messaging lands without over-explaining. Sales conversations move faster. Customers describe the product in ways that sound familiar, not rehearsed. Growth becomes more consistent, not spiky. When the fit is right, progress feels earned, not forced.